Geo Energy Resources ($RE4) - Cheaper than ever?

Geo Energy is an Indonesian coal miner with two main producing mines (SDJ & TBR mines), in the South & East of Kalimantan.

Disclaimer: This content does not consitute investment advice. Investing in cyclical companies requires deep knowledge of the stock and the market they’re based off. You are responsible for your own investment decisions, so do your own research. I hold long positions in the stock mentioned here today.

More than one year has passed since I made the initial article on Geo Energy Resources and the stock has had its ups and downs, has paid a fair share of dividends, and it has risen from 0.265 SGD to its current share price of 0.32 SGD (+20%). Even though the share price is higher than back then I believe the stock is much cheaper today. If you don’t know much about Geo Energy Resources I would recommend reading the first article.

As for the performance of the stock we have to consider that since Sept 2021 they have paid 0.13 SGD in dividends so the total percentage gains would be close to 70%.

Geo Energy over the past year

On the operational side cash costs have gone up and production has gone down Despite reduced production and higher costs Geo Energy has been extremely profitable during 2022, earning 141M$ over the first nine months of the year. They have also paid 0.09 SG$ in dividends during that time period and they have also built a massive net cash position of over 200M$, representing close to 60% of their market cap.

Before talking about 2023, I want to point out that the fourth quarter of 2022 is likely to be a very strong one for various reasons.

The first one is that Geo Energy had already sold most of the production that needed to be sold to the Domestic Market Obligation during other Q1 to Q3, precisely 2.5Mt. Therefore in Q4 they will only need to sell 0.5 million tonnes at the reduced DMO pricing (38$/t) and the rest of production will be sold at spot prices. Production in Q4 should pick up aswell given the guidance from management, and finally the average price of Indonesian Coal has been higher during Q4 than during the rest of the year, averaging more than 90$/t during the quarter.

I’ll give more details of the 4th quarter in the valuation section of the article.

Outlook for 2023

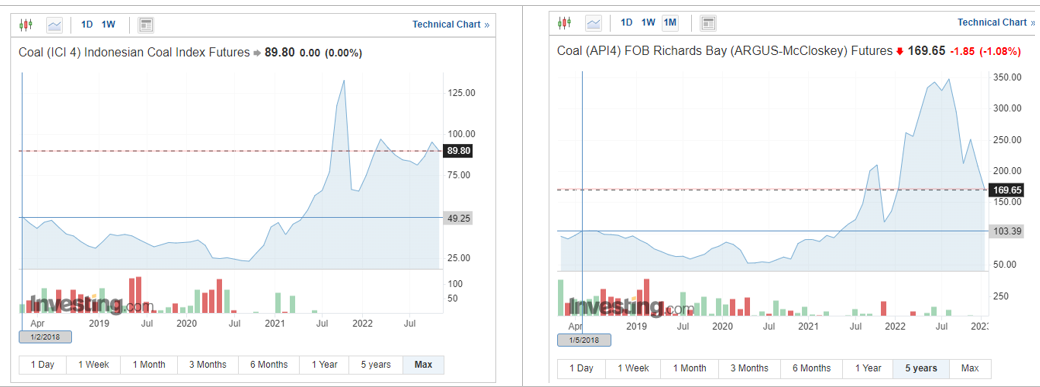

Thus far 2023 looks very nicely, with coal futures trading solidly above 75$/t for the entire year.

Even if we take the scenario where their cash costs stay at elevated levels and their production goes down to 10 Mt, I have Geo’s FCF for 2023 at around 150M$ (2.25x current market cap) at 75$/t ICI4.

There is some negative things to point out for 2023 though:

1.- Royalties for Geo Energy mines will increase from a flat 3% to a 5-8% based on coal pricing. At ICI4’s current price the royalty regime would be a 6%, therefore we should expect their net margins to shrink by the amount of the extra royalties.

2.- There have been rumours about an increase in the Domestic Market Obligation (DMO) rate from the current 25% of production to a 30%. There were also plans to change the way the DMO mechanism works but so far there is no confirmation any of these is going to happen.

3.- The effective tax rate should be expected to rise, since the cash is generated in Geo Energy’s Indonesian subsidiary and in order to pay dividends or buybacks it needs to be transferred to their Singapore entity, which implies a 10% withholding tax.

4.- Overall mining costs to rise further. The strip ratio in one of their mines has risen substantially over the past year, and after further talks with management, it seems like due to the geology of the mine costs are expected to stay elevated. Given that their costs have already risen by a lot any further increase in costs will make the company vulnerable in an environment of lower prices.

Even if the DMO changes were to happen I don’t think it would significantly hit Geo’s profitability for next year. In the case of the royalties I’m simply assuming that their cash costs will increase at least by a 3% of ICI4’s pricing.

As for the DMO mechanism it wouldn’t be a big difference from last year. Let me explain, the DMO means that indonesian coal companies need to sell a 25% of their production quota to a public utility (PLN) at a capped price of 38$/t. Geo Energy’s quota for 2022 was 12 Mt, so they needed to sell 3 Mt to the PLN. Even though their production will likely be below 11 Mt they still need to sell the amount based on the quota they had. If we assume they are actually able to produce 11 Mt their DMO obligations for last year will have been a 27.3% of production, so increasing it to 30% would just mean selling an additional 2.7% which wouldn’t be very impactful.

Indonesian Coal Outlook

Before talking about the valuation let’s focus on the coal Geo Energy sells. It is a coal with low calorific value (4200 kcal/kg) but with low sulfur and ash content aswell. According to Geo Energy’s management, despite its lower calorific value it is necessary for blending with other types of coals (Chinese, Australian…) in order to be used for power generation.

I haven’t found data related to the CO2 emissions of ICI4 coal per unit of energy generated, but since it’s calorific power is lower I assume the CO2 emissions are higher than for other more energy dense coals. But still, if we look at the following graph, we can see that the main countries buying indonesian coal don’t really care much about CO2 emissions.

The main two importers seem to want even more coal, since China very recently resumed the imports of Australian coal and India just asked their utilities to import more coal.

Comparing differents types of coal

I’ve made this chart to show how much have these different coal types and LNG risen from the previous peak in 2018, and how much have they gone down from their 2021-2022 peak, aswell as the relative pricing per unit of energy produced.

As we can see ICI4 is still very competitive with other types of energy when it comes to its pricing per unit of energy. I have researched the average price per MMBtu for different types of coals and JKM to see what’s the average historical discount for Indonesian Coal during the past few years.

I will base most of my conclusions based on 2018 and 2019 pricing, given that 2020 was an abnormal year due to COVID, and 2021 was abnormal aswell since China blocked the imports of Australian coal. I would have liked to use more data from previous years to 2018, but I couldn’t find some of it.

So, as we can see, API4 (South African coal) traded on average at around a 50% premium to ICI4 on an energy basis during 2018-19. This is pretty close to the current premium, which is around 40%. Newcastle traded at a 66% premium to ICI4 during those years while its current price is 3 times higher than ICI4. We can also see that Newcastle usually traded at a slight premium to API4, so given historical prices Newcastle should go down and settle at prices slightly above API4 (170$). API5 has usually traded at a slight premium to ICI4 aswell which has widened over this past year. At the same time JKM LNG’s premium has gone up from an average of 225% during 2018-19 to over 370% in 2021 and much higher in 2022.

My conclusion from this is that both Indonesian Coal and South African are fairly valued when it comes to their historical relative valuations. On an absolute basis ICI4 is still a very cheap energy source when compared to alternatives. LNG is still very expensive but I don’t expect it to go down in the near term. Newcastle coal seems to have held surprinsingly well, but I think it’s a matter of time until it settles at its slight historical premium to API4. When it comes to API5 I don’t have access to current spot prices but I believe it has gone down recently. Its premiums were just slightly higher than average so it seems like it’s relatively fairly valued aswell.

Finally these are the charts of the energy types analyzed. My final conclusion is that I feel much more comfortable with ICI4’s pricing than with other coals like Newcastle. For its part, ICI4 has been very stable for this past year, aside from a brief spike to 130$ during the Chinese energy crisis that crashed to 70$ when China ordered their miners to increase output as much as possible. Since that happened prices have hovered pretty stable around the 80 to 100$ mark.

Earnings Model for Q4 22’

Their current market cap is around 332M US$ (at 0.315 SG$/sh), and the net cash currently is around 200M US$ already accounting for the third quarter dividend paid. Considering that their fourth quarter should be a very good one their net cash will very likely be above 250M$ by Q4-end, giving an Enterprise Value of less than 100M$.

Geo had a quota of 12 Mt for 2022 but given production problems management guided for 11 Mt. They produced 1 Mt in October, therefore if they were to hit 11 Mt the production for November and December would have to be 1.2Mt per month, so I’m only considering 10.6 Mt of production for FY 22 (1Mt per month for Q4).

I have modelled their fourth quarter given these assumptions:

·Pricing: 85$/t on export sales, 38$/t for their DMO.

·Million tonnes produced/sold: 2.5 Mt export sales, 0.5 Mt DMO.

·Cash costs: 45$+3% of ICI4 (47.55$). I’ve increased their cash costs due to the royalty increase.

· Average G&A, other expenses and CAPEX of other quarters. In the past quarter “Other Expenses” went up due to a tax they have to pay to move money from their Indonesian subsidiary to the Singapore company, therefore I’m using an additional 5% expense on their pre-tax income.

· Tax rate: 23%

Given these numbers the post-tax FCF generation would be around 70M$ and net profit around 60M$, resulting in a net cash position of ~270M$. Based on the minimum payout the dividend for Q4 22’ should be at least 0.02 SG$ (6% yield from Q4 alone).

Therefore their FY22 multiples would be the following:

· Market Cap: 350M$ - Net Debt: -270M$ - Enterprise Value: 70M$

· 200M Net Income (1.7x PE).

· 225M FCF (1.5x MCAP/FCF – 0.33 EV/FCF) – Obviously this free cash flow has been adjusted for dividends and buybacks.

Earnings Model for FY23’

For FY23 I’ve used these assumptions:

·Pricing: 75$/t on export sales, 38$/t for their DMO.

·Million tonnes produced: 10Mt, 7.5 Mt export sales, 2.5 Mt DMO. I’m not accounting for the possible increase in DMO obligations, but I’m using a low-guidance of 10 Mt. For instance FY22 production should be around 10.6 Mt – 11 Mt.

·Cash costs: 42$ + 3% of ICI4 pricing (44.25$). I reduced the cash costs a bit since their costs are linked with the coal price aswell. Even though there is no precise numbers I estimate it to be a 30% of the coal price, so for a 10$ decrease the cash costs should decrease around 3$ all else being equal.

· Average G&A, other expenses and CAPEX of other quarters. In the past quarter “Other Expenses” went up due to a tax they have to pay to move money from their Indonesian subsidiary to the Singapore company, therefore I’m using an additional 5% expense on their pre-tax income.

· Tax rate: 23%

With these assumptions Geo would generate:

· ~140M Net Profit - 2.4x earnings.

· ~150M Free Cash Flow - 2.26x MCAP/FCF.

Given the 140M Net Profit, the dividend yield based on the minimum payout would be ~12% for FY23.

Valuation

Since the company is clearly trading at very cheap FCF multiples and has around 70% of their market cap in cash I think a big part of the valuation is qualitative, the market clearly thinks the cash won’t be used in accretive ways for shareholders. I will talk about this in detail in the next section, but for now here are different simple ways to value Geo Energy.

· On the one hand I want to adress the net cash position. It is a key part of their current valuation and the question that we have to ask ourselves is: How do we value it? How do we value money the company has but that we cannot access? For the time being I’m going to discount 50% of the net cash.

So, from the 270M expected cash at the end of 2022 it would add 135M$ to the valuation.

· Secondly, how do we value the FCF? Which multiple do we use? In this case I’m not going to use a high one either, it wouldn’t be fair when we look at other coal companies, most of them are trading at 2 times FCF or so. I think the cash flow might be more valuable on companies that have higher fixed dividend policies, like Yancoal, but in the case of Geo Energy the dividend policy is a minimum of 30% of earnings, so we will surely benefit from the cash flows.

With that being said I came up with three conservative valuations in my opinion:

1.- Discounting the net cash by a 50% and adding 2x 2023 FCF:

Market Cap: 430M$ - Share Price: 0.41SG$ - % Change: +25%.

2.- Net cash + 1x FCF:

Market Cap: 405M$ - Share Price: 0.38SG$ - % Change: +17%.

3.- Discounting the net cash by a 50% and adding 1x 2023 FCF:

Market Cap: 285M$ - Share Price: 0.27SG$ - % Change: -15%.

Finally, in a less negative valuation I think it would be fair to value the cash without discount and valuing their FCF at 1.5x times given the lower than average reserves.

Market Cap: 485M$ - Share Price: 0.46SG$ - % Change: +45%

With this valuation we would come up with a 45% upside.

Reasons for Geo Energy’s cheapness

In general coal companies are trading at extremely low valuations, Yancoal ($YAL.AX) is also trading at around 1.5x their 2022 FCF to equity, Peabody Energy ($BTU) is trading at around two times their 2023 EV/FCF.

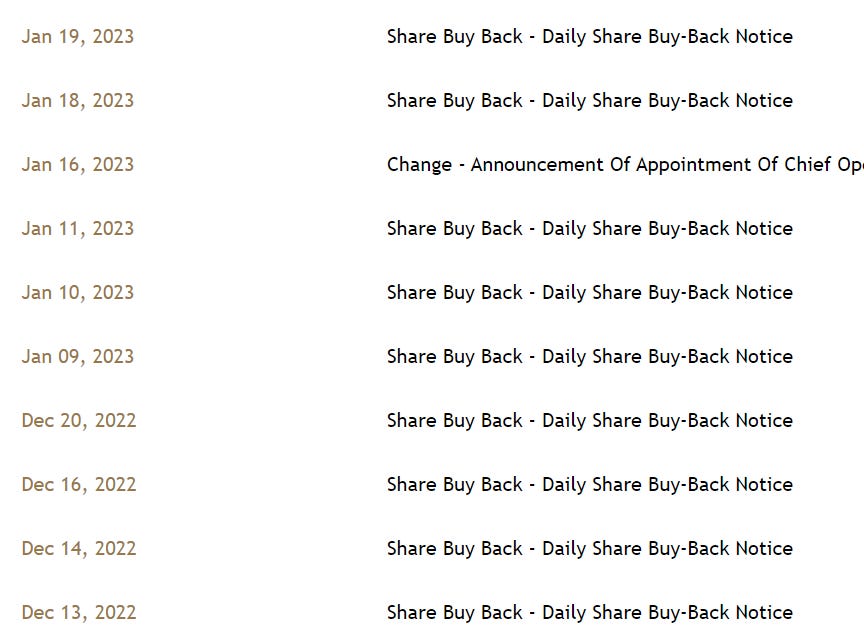

The capital allocation has not been perfect, in my opinion given the huge net cash reserves and the good outlook for 2023 there really isn’t any better investment than buying your own shares. Even though management is not too keen on big share buybacks, they have bought back around 0.5% of shares outstanding during this past month.

Low reserves in their mines. Geo Energy mainly owns two mines – SDJ and TBR. SDJ produced 4.5 Mt while TBR did 6.3 Mt in 2021. By year end 2022 I estimate SDJ will have about 3 years left of reserves while TBR around 8 years. We will see if they have added some new reserves once their Annual Report is out, but I wouldn’t expect much of it, for the past years they have barely added new reserves to their mines. There is therefore uncertainty about what will happen with Geo once the SDJ reserves run out, and the market usually doesn’t like uncertainty.

Another reason why it could be this cheap is the increase in mining costs over the past year. Their breakevens have risen by a lot, therefore if ICI4 prices were to go down to the 40$ mark they might not be profitable anymore, whereas around 2 years ago their mining costs were below 20$. To be fair, after writing this article and talking with management I am a bit concerned about it, we will see if they are able to stabilize them over this year.

Downside scenarios and adressing concerns:

I am going to adress now the negative scenarios, and also the concerns I’ve read from other shareholders on forums. I think most of them really are blown out of proportion or unrealistic.

I see a few negative scenarios/concerns, mainly the following:

1.- Coal prices cratering: Any commodity company will suffer if their index goes down. I have covered this though, I don’t think the fundamentals really support this as long as other energy sources are trading at high prices aswell.

2.- A ‘bad’ acquisition. It is true that the company is looking for an acquisition. Given their low reserves it is understandable that they would like to secure other assets to make sure the company is here to stay. I don’t see a reason why they would go for an acquisition that wasn’t accretive to shareholders to be honest, since the current CEO – Charles Antonny Melati – holds around 36% of the shares and in between different other executive directors they hold a 5% stake. Apart from the shareholding % I like to look at their holdings based on their salary. The biggest two inside owners apart from the CEO hold around 10 times their salary in shares, therefore I would assume it is an important part of their capital. Given that they have actual skin in the game I don’t see a reason why they would do a bad acquisition or rush it. I mean they still have 3 years left on one of their assets, and the other has 8 years left, so they still have plenty of time to wait for the right opportunity.

3.- Private takeover of the company: Another concern I’ve read from shareholders is that they are hoarding cash in order to take the company private at a low price. I think this one is completely unrealistic. The SGX has pretty strict rules for takeovers: a 75% of the independent voters need to vote in favour. Management has been treating shareholders in a fair way and they have always been open and transparent to questions from me and other shareholders, so I really don’t see this happening.

Most downside scenarios in my opinion are pretty unlikely and it would mean that the company would have to be managed in bad faith which hasn’t happened either.

Conclusion

The reason that I like Geo Energy at this price is that I can make negative assumptions in most parts of their business – production going down, costs going up and coal pricing going down – and despite all this I think the downside is quite limited given the cash reserves. For instance, if Geo Energy’s shares were to drop by a 20% the market cap would equal more or less their net cash. I also feel much more comfortable being exposed to spot pricing in ICI4 than in other coals like Newcastle given how cheap ICI4 is relative to other energy sources.

We’re not buying a company in a pretty sector, the coal they produce is not high quality one, the capital allocation might not be perfect, yet, at this price, I haven’t seen anything cheaper than this as a combination of FCF generation plus balance sheet strenght.

As Howard Marks says:

It's not what you buy, it's what you pay. And success in investing doesn't come from buying good things, but from buying things well.

And in this case I think the price you pay is simply too cheap to ignore.

That’s it for now, I hope you liked the article, and if you did you can help me by promoting it and subscribing to the newsletter. If you have any questions or thoughts on the article leave a comment here or on Twitter.

Finally I have also made a spanish YouTube video talking about this article:

Thanks a lot for the analysis.

I understand that, when valuating the company, you are trying to figure out how the market can value it more than calculating the intrinsic value.

In the case of this company which has a pretty limited production in years, to my undestanding, it would be more indicative on how far current price is from intrinsic value making a simple DCF calculation using for 2024-2029 conservative normalized scenarios. By doing that the current valuation looks simply ridiculous.

Although as shareholders we would like to see more allocation on buybacks or dividends, I understand that management tries to find a future for the continuation of the company and there is no reason, At least I don't find it, to think that the management will take a really wrong decision both because they are very large shareholders and the decisions they took in the past were very good for creating value (example repurchase of debt in 2020)

sadly management team sucks, what you want to see in a coal company is huge buybacks and fat divies, but now, they are hoarding cash like dumbasses