Geo Energy Resources (RE4: SGX)

An indonesian coal miner trading at extremely cheap multiples

GEO ENERGY RESOURCES

Geo Energy Resources (Stock Code: RE4) is an Indonesian coal miner trading in the Singapore Stock Exchange. The company has had an amazing transformation over the last 12 months and I believe it is amongst the cheapest companies I have seen in the stock market.

Investment Thesis:

Geo Energy is an Indonesian coal miner with two main producing mines (SDJ & TBR mines), one that very recently started opeations in Q2 (BEK mine) and a fourth one (STT) which is in exploration and development process in the South & East of Kalimantan.

As you might know, coal prices are at the highest point they’ve been since 2008. Geo Energy’s coal reference index is the Indonesian ICI4 Coal Index. Indonesian coal has a lower calorific power than other coals (~4200kcal/kg), therefore it trades at a discount to, for example, Australia's Newcastle coal (5500kcal/kg).

Not only has the ICI4 index almost doubled YTD but the futures are trading at much higher prices.

As with shipping, mining companies are very leveraged operationally, so if the commodity they are selling rises above their breakeven, most of the extra revenue goes directly to the bottom line. Geo Energy’s mining costs have been in between 20 and 26$/t for the past quarters, therefore we can expect their mining margins to substantially increase over the coming quarters.

With all these bullish arguments one could expect the company has doubled or tripled YTD as many other US coal miners like BTU (360% YTD) or Consol Energy (280% YTD), but far from that it’s up a respectable 40% YTD.

Some of their costs are linked to index prices though so not all of the price increase is going to go directly to the bottom line. Indonesian coal miners are also obliged to sell a 25% of their production locally at lower prices. For Geo Energy’s coal this price is capped at US$38/t whereas ICI4 averaged 47.78$/t, so we can expect their ASP won’t replicate the ICI4 index at a 100%.

It is uncertain what a % of their costs are linked with price, but even in a negative scenario where their extra earnings are shared 50-50 with their mining operators and the price for their domestic sales stays at 38$/t, Geo Energy is trading at extremely cheap multiples as I’ll show below.

Geo Energy produced 5.6Mt of coal during 1H. They recently got a government quota raise, being able to mine around 11.5Mt for the entirety of 2021.

Geo Energy 1H 21’ data

If you didn’t take a closer look at the company you could think that earning US$49M (SG$ 135.4M annualized) in the first half is already an outstanding result for a company with a market cap of ~SG$370M (>3 PE). But modelling their future earnings based on current coal prices gives a much more bullish outlook.

Geo Energy 1H 21’ data

Geo Energy also announced the redemption of their remaining USD bonds, the increase in production quota from 10Mt to 11.5Mt for 2021, and very importantly, they gave guidance regarding their performance in July:

They earned US$18.6M in just one month! If they earned the same amount as in July for the entirety of the second half they’d be earning US$111M in 2H 21’. It’s important to note that since the company trades in the Singapore Stock Exchange their US$ earnings have to be converted to Singapore Dollars (1 USD = 1.36 SGD), so they’d be earning SG$150M in 2H if they were able to recreate their July performance. The company has a policy of paying 30% of their net income as dividends, so as shareholders we’ll definitely benefit from its earnings and low multiples.

Additionally, they recently started mining operations in their 3rd mine (BEK) during the second quarter. They only mined 0.1Mt in BEK during Q2 but since they started the operations during that quarter the production from that mine might increase in the future.

Future earnings

Model Assumptions: The assumptions in the model are quite pessimistic. I’d say the base case of the model would be much more bullish.

Production of 5.4 mt for 2H 21’. For reference they produced 5.6mt in 1H and have a total production quota of 11.5mt for 2021 (implies 5.9mt in 2H).

Assuming Q3 earnings to be:

Assuming the July earnings mentioned by the company (US$18.6M). Assuming a 10% discount for August and September earnings ($16.8M). In reality I’d probably say they earned more in August and September, since average ICI4 prices for July were around ~65$/t, for August ~69$/t and for September 77.2$/t.

Q3 earnings: 18.6 + 16.8 + 16.8 (USD)

Assuming Q4 earnings to be:

Coal sales of 0.9mt per month.

25% of their domestic obligations sold at 38$/t.

75% of the remaining production sold at 85$/t (-20% of current futures).

50% of the incremental revenue split with producers.

Finance expense to be 0.

G&A of 6M USD, other expenses to be 4M USD.

Tax rate 23%.

Assuming 1H 22’ earnings to be:

Coal sales of 0.9mt per month.

25% of their domestic obligations sold at 38$/t.

75% of the remaining production sold at 68.8$/t (-20% of current futures).

50% of the incremental revenue split with producers.

Finance expense to be 0.

Tax rate 23%.

Results

Using these very conservative assumptions Geo Energy is trading at a FWD PE of 1.387 and if they maintain their dividend policy we’d be getting at least a 21.63% dividend yield at its current price of 0.265 SGD

How conservative is the model?

I’d say it’s actually very conservative. Going through the assumptions:

Coal production: I think given current prices it’d make sense for Geo to use its entire coal quota, so that’d be an extra 0.3mt of production for Q4 21’ and 0.4mt for 1H 22’. Additionally they started operating a third mine in the 2nd quarter of this year. They only produced 0.1Mt but going forward there is the possibility of additional mining there.

Cash cost: The 50-50 split on the extra revenue I’d say is also very conservative, I’d doubt their costs are indexed for more than 20 to 30%.

Price: Usually the ASP lags market rates and in the 2nd quarter their ASP was a bit disappointing so using a 20% discount feels fair, these are also futures quotes and the price might go down.

I’m not going to leave the calculation here but with a more bullish assumption I don’t think it’s unreasonable to think the company is trading at >1 PE or close to 1 *if coal prices hold up*. Realistically, if we just annualize their July earnings they’d earn SG$300M in the next 12 months (1.2 PE). In reality, most of the coming months will be better than July.

Either way, these multiples are very low, and if in a pretty conservative scenario they are trading at a PE of ~1.4 that’s fine with me.

Balance sheet:

Geo Energy has a very healthy balance sheet, with a net cash position of US$22.77M. They recently redeemed most of their remaining debt, so it is expected that when they release their 3Q results the company will have no debt (or barely any).

Forward Balance Sheet

I’ve talked about the company’s earnings and assumed a 30% dividend payout, but what about the other 70%? How does the company’s balance sheet look like 1 year from now if they were to keep all that cash?

In 1 year from now, Geo should have a net debt of -209,89M SGD according to my model, and given its current market it would imply an EV of 160,91M SGD. The final calculation I’ve done is the market cap the company would need to keep its enterprise value at the same level it is today (348M). That’d be a market cap of 557,92M SGD, a 50,46% return in 1 year plus a 21,6% dividend at current prices.

Another thing to mention is that the company is domiciled in Singapore and there is no withholding tax for dividends.

Management:

Now that we’ve reviewed the financials let’s talk about Geo’s management. With the company trading at such cheap multiples one could think that they are not competent or that they do not reward shareholders; but it is the other way around.

I would say Geo’s management has navigated 2020 extremely well, creating value for shareholders and rewarding them through dividends at the same time.

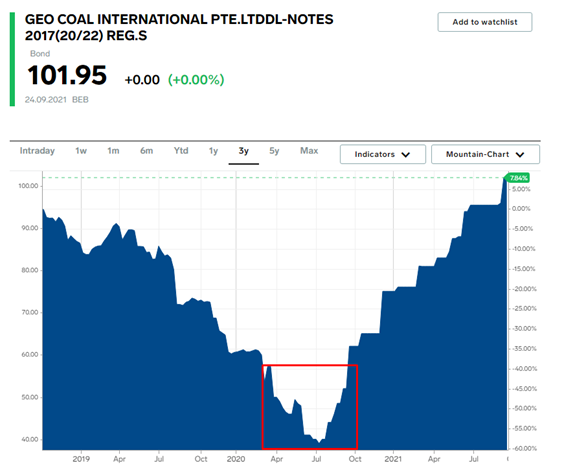

The most impressive corporate action they took over the last year has been the repurchase of their USD bonds in the open market for almost half their principal value. They repurchased US$240.8M of principal amount for US$128.8M (53.8% of principal value), resulting in a gain of US$112M and a significant reduction in finance expenses, since the bonds carried an 8% interest.

They recently redeemed the remaining amount of bonds, therefore the company has gone from having a debt of US$280M at the end of 2019 to being debt-free and having a net cash position as of today.

Looking at the price of their bonds, it looks like they must have bought most of it during the lowest point in the last 3 years, which I must say is just impressive timing and has created huge value for shareholders. To put the gains into perspective, the stock was trading at almost half its current price (SGD$0.12 ~ SGD$165M market cap) when they repurchased the bonds, so they almost gained the entire market cap at the time (US$112M or ~SGD$150M) from the bond repurchase.

One important thing to mention is that Geo Energy files their results quarterly and they have earnings presentations alongside their results. They also regularly give data in their presentations with the outlook for the upcoming quarters and they have regular press releases with important information for shareholders. A lot of Asian stocks file their results semi-anually and don’t provide investor presentations, so I’d say their communication with shareholders is very good.

Insider ownership:

Insiders have a high % of ownership in the company, but at the same time it is split in between different insiders, so the CEO doesn't own most of the shares like in many Asian companies. There has barely been changes in the insider ownership for the last 3 years, so with this level of insider ownership I would say management is aligned with shareholders.

Source: TIKR.com

What will they do with all the cash?

Geo Energy currently has a dividend policy of at least 30% of net income. In previous reports they have mentioned that it was due to the covenants on their bonds, and that once they were paid they’d have the possibility of raising the dividend.

I am not comfortable with the mention of divestments and diversifying into renewables. I would like it better if they expanded alongside the coal supply chain, but at the same time management has been doing a great job for this past year, and considering they own most of the shares outstanding I doubt they would divest their productive mines or diversify into renewables projects with low IRR.

Coal Outlook

While a lot of people believe coal is dead, the reality is that most energy usage forecasts coal consumption to stay relatively constant until 2050, even though the usage as a % of the energy mix will decline.

I think another trend that might benefit ‘dirty’ industries over the coming years is the ESG trend in advanced economies, where shareholders are pushing for the companies to reduce their emissions. I don’t think this will happen to operators in poorer countries like Indonesia.

https://www.pv-magazine-australia.com/2021/07/01/agl-energy-pushes-ahead-with-plans-to-split/

https://www.bbc.com/news/world-europe-57257982

Conclusion:

I have personally been looking at many coal operators over the past week and I haven’t found any other as cheap as Geo Energy. The biggest strength over other miners is that they are debt free. Many other operators are trading at cheap multiples but they are extremely leveraged, so even if they are trading at cheap multiples relative to their market cap, they are not so cheap when you look at multiples with enterprise value. For Geo I’d say it’s the other way around, if you use EV they look even cheaper than if you use metrics using their market cap.

I have been invested in Geo Energy for a few months now with a pretty good profit from my first buys (around +50% plus dividends) but it feels like it’s now much cheaper than ever.

Q4 futures recently spiked from around ~85$/t to 105$/t as of the day I’m writing this.

I personally think the company has very little downside at its current price, their 2021+2022 earnings will likely exceed its current market cap and with no debt, you are buying this coal miner for “free”. The risk that’s inherent to investing in any cyclical is the price of the commodity going down, but I don’t think coal prices are going to go down in the short term. There are energy shortages all across Europe and Asia (China specially) and winter hasn’t even started yet. If there’s a cold winter coal prices could actually go even higher.

https://www.bloomberg.com/news/articles/2021-09-27/china-s-power-crisis-moves-from-the-factory-floor-to-the-bedroom?sref=FE7zXxCC

The biggest risk in the thesis could probably be the use of the pile of cash they’ll be sitting in, but I am comfortable investing here if that is the biggest risk.

Note: I wrote the article alongside the weekend, I used for calculations yesterdays’ share price (0.265 SGD).

Disclaimer: I am long Geo Energy Resources. This is not investment advice, do your own research.

Great piece! Thank you!

Esta acción no se mueve nada. Es un poco raro con lo barata que está no?