Tsakos Navigation - Benefiting From Tanker Rates At A 60% Discount To NAV

An in-depth review of the company's history, their charter book and management.

Disclaimer: This content does not consitute investment advice. Investing in cyclical companies requires deep knowledge of the stock and the market they’re based off. You are responsible for your own investment decisions, so do your own research.

Tsakos Energy Navigation (NYSE: $TNP) is a diversified tanker company owning over 60 ships and transporting mainly crude oil and products (diesel, gasoline…) aswell as owning three LNG ships. Over this past year and specially since the start of the Ukraine war tanker rates have spiked to very high levels so Tsakos is one of the main beneficiaries of the lucrative tanker market.

Shipping is a very commoditized industry: pretty much every company will do well if the market rates are good. My philosophy when investing in the sector is to find the best companies based on valuation and shareholder returns. So, does Tsakos fit this criteria? Let’s find out.

Tanker Market Review

The dislocations caused by the Ukraine war resulted in higher shipping rates for both crude and product tankers. Basically, since Europe has sanctioned russian oil they have to transport it further to countries like China or India, and Europe has to import the fuel from somewhere else increasing the tonne-miles for the overall segment.

Rates have started easing up specially for product tankers and VLCCs but they are still very profitable. Despite that, the outlook for most tanker segments is pretty good. The orderbook is very low and there are some catalysts that could make rates go up like China’s demand picking up after the Chinese New Year and the EU ban on Russian oil products, which starts in February.

Tsakos Equity & Debt

First off let’s look at Tsakos’ debt and equity structure. Given that Tsakos has been paying dividends on the common shares for the past 20 years and that preferred shares’ dividends have priority over common shares I’ve considered the prefs as debt and I have included the payments on the EPS calculations.

Tsakos Common Shares: 28 630 206 shares.

Series D Preferred Shares (Par Value 25$ | Coupon: 8.75%): 3 517 061 shares | Total: 87.93 M$

Series E Preferred Shares (Par Value 25$ | Coupon: 9.25%): 4 745 957 shares | Total: 118.65M$

Series F Preferred Shares (Par Value 25$ | Coupon: 9.50%): 6 747 147 shares |

Total: 168.68M$

Series G Convertible Preferred Shares (Par Value 10$): 459 286 | Total: 4.6M$

Net Debt (Excluding Preferred Shares): 1293.25M$.

Net Debt + Preferred Shares: 1673.11M$

Market Cap (At 17$/sh): 486.7M$

Enterprise Value: 486.7+1673.11 = 2159.8M$

Tsakos Trailing Valuation

Now, let’s compare Tsakos’ earnings and ratios with other tanker stocks. I’ve taken the earnings from the last quarter and last half and annualized them to see their relative cheapness.

The cheapest companies are all product tankers ones. This is simply because product rates went higher much earlier in the year. Fourth quarter product rates were similar to 3rd quarter so the earnings should stay flat for Q4 and for Q1, I expect them to be weaker. We will have to see if rates start picking up from the EU Russian product ban.

At first glance, Tsakos’ doesn’t look very attractive based on trailing earnings multiples. They’re relatively cheap but you would expect a company that is hugely levered in a strong market to be the cheapest one by far. This is mainly because of Tsakos’ fixed time-charters which are not benefitting from the current market strenght.

At the same time, using NAV numbers they’re the cheapest one in this group. So even though for every dollar you are paying for Tsakos’ equity you are getting a lot more ships they really are not earning that much. Finally, if we use multiples that take into account the debt like EV it is more expensive.

Still, if those time charters expire soon and Tsakos is able to realize current market rates their EPS would significantly increase. Therefore, let’s have a look at Tsakos’ charter book and then we’ll talk about the forward valuation.

Tsakos’ Charter Book

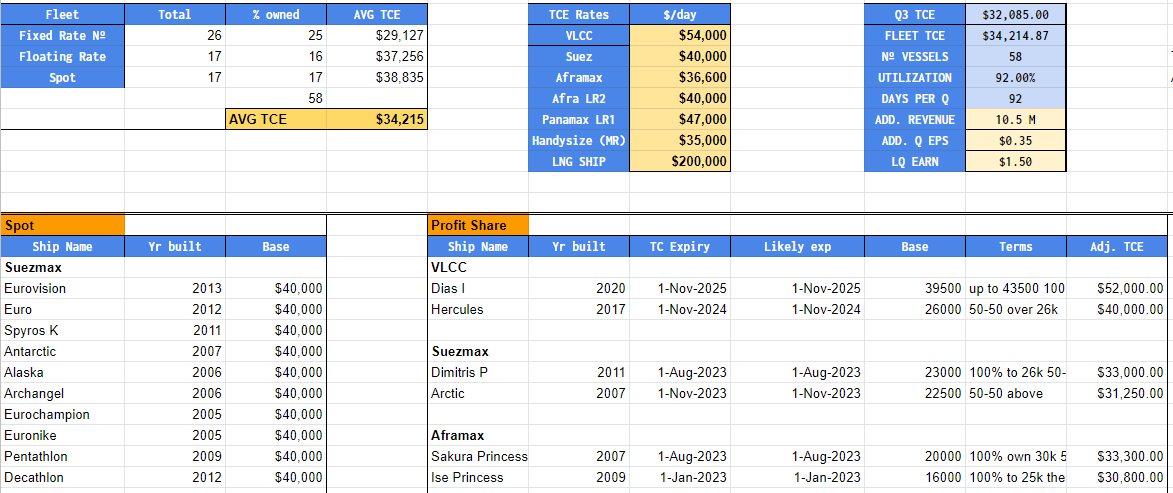

Tsakos’ fleet consists of 58 vessels right now. I’ve adjusted the numbers for the following:

Brokers have reported that Tsakos recently sold their 6 MRs although they haven’t confirmed it yet.

Four of their ships are only 51% owned so I’ve adjusted it for their stake.

Not accounting for upcomming newbuilds.

Of those 58 vessels:

25 are trading on fixed-rate contracts.

16 are trading on floating-rate contracts.

17 are trading in the spot market.

Let’s have a deeper look into their fixed-rate contracts. Out of the 25 fixed-rate vessels one of them is a VLCC, two of them are LNG ships, two are Handysizes, two are Suezmaxes, four are DP2-shuttle vessels and fifteen are Aframaxes.

One of the most important charters expiring for Tsakos in the near term is the one for the LNG ship ‘Neo Energy’, which currently earns only 37000$ a day. For instance, CoolCo was able to charter one of their ships at 140 000$ a day for 12 months back in September. I don’t expect Neo Energy to get such a high rate because it is a ship with older technology, but I can see them getting 80-100k$ for one year, which would mean an additional 0.50 to 0.80$ in annual earnings per share. Other than that the other ships are expiring further than 1 year out so there won’t be additional earnings from them in the near term.

I’ve added the options attached to the vessels (most of those options are in the money) to calculate the final expiration date. You can check Tsakos’ full charter book here, but they don’t list the options in that file, you have to go to the SEC 20F filing.

In the Suezmax and DP2 front there is also no near term charters expiring. There are two important things to note here: DP2 vessels are Suezmaxes that have dynamic positioning equipment and they work with offshore oil platforms, so their market dynamics might follow oil prices and oil offshore demand more than Suezmaxes’ rates. I find that the charters they were able to get for their DP2 vessels are pretty good, the ships are more expensive than a normal Suezmax but they are getting very lucrative long-term charters.

Finally, when it comes to Aframaxes they have three ships expiring this year at an average of 28k$. Current spot rates are around 40 to 50k$ a day, but it’s only three vessels out of 58 so the contribution won’t be that significant.

Then, when it comes to the bulk of their Aframax charters we would have to wait until 2028 for the expiration. They are commiting to very long-term charters on some of their ships at rates that are dangerously close to breakeven levels. For instance, according to their most recent presentation, the cost to operate an Aframax for Tsakos is 19 227$, including OPEX, G&A, interest expense and depreciation.

On average they are making less than 3 000$/day on these very long term charters. But, what if interest expenses go up? What if OPEX goes up? Or what if the vessel is simply worth a lot less than what you’ve depreciated it because of regulations 10 years from now? At the same time those charters usually expire a lot sooner but they have extremely long option periods at the choice of the charterer. So, if the tanker market is terrible the charterer could return those ships to Tsakos at the worst possible time. In general I find those charters to be quite poor, and obviously they are not gonna get market rates anytime soon.

My issue with NAV valuations is exactly this one: Tsakos’ ships that are on long term charters are definitely not worth their market value. Some NAV valuations discount below-market charters, but I’m not sure if it’s discounted enough.

Floating Rate Contracts

When it comes to their floating-rate contracts I find them to be much better than their fixed-rate ones. In general those contracts have a floor and then a profit sharing agreement until a certain point. These kind of contracts work best in a bearish or slightly bullish environment, since they won’t lose a lot of money even if rates are terrible, but if there is a very strong rise in rates, like what happened in 2022, they won’t benefit that much since they are capped at a certain rate.

Most of their ships expiring are Panamax Product tankers (LR1) so if rates rise with the EU ban on Russian diesel they could benefit significantly. In general their floating rate contracts are pretty good.

Spot rates

Finally, out of the 17 vessels trading in the spot market, one is a LR1, two are Aframaxes, four are Handysizes and ten are Suezmaxes. In this regard they are well positioned since Suezmaxes’ rates have held up very well despite the weakness in other classes.

In general they are not too badly positioned although I really don’t like their fixed-rate chartering policy. Their floating rate contracts are okay, they have an LNG ship expiring soon and they have a significant presence in the Suezmax spot market.

If you want to see the sensitivity of spot rates to the average TCE rates Tsakos will achieve I have created a Google Sheets file which I’ll send to all of my free subscribers this weekend. The file also has a very basic model of the additional revenue Tsakos would receive based on the input data.

Tsakos’ Forward Valuation

After looking at Tsakos’ trailing valuation let’s look at the forward one given the improved market rates. One thing I’ve noticed is that Tsakos’ breakeven levels are much higher than any other peer. The closest peers to Tsakos would be Teekay Tankers ($TNK) and International Seaways ($INSW) due to similar fleet age and profile. TNK’s average age is over 3 years older than TNP and as ships age they’re more expensive to run. On INSW side their breakeven is lower despite similar age since half of their operating days come from MR ships, one of the smallest of the tanker classes.

For Tsakos, they have 3 LNG ships and four DP2 shuttles with higher operating costs. Also they’re more expensive ships so depreciation and interest expense will be higher, but I’m not sure if enough so that seven ships out of 64 for Q3 would add over 5000$ in additional expenses per day per ship. Comparing them we can see that Tsakos’ net income breakeven is 4300$ higher than TNK and 5500$ higher than INSW.

High costs are the bad part, now the good part is that a 7000$ increase in net TCEs to Tsakos would double their margins. Can they achieve that for Q4 or 2023?

What I’ve seen for tanker companies is that the variability in between the average TCE for every company is huge when comparing the same classes even when the avg age of the fleet is similar. So at the end of the day it seems like it depends a lot on the prowess of the chartering department of every company.

Any additional increase in the average TCE for Tsakos will have to come mainly from their spot rate ships or the profit-share ones. The issue is that the age of those vessels is in general very high.

Spot Rate Charters: 15.2 years.

Profit Share Charters: 11.9 years

Fixed Rate Charters: 8.4 years

None of their ships on spot rates contracts have scrubber and the youngest one is 10 years old. Market rates are still really good though but I would expect a discount given the aged fleet. For profit sharing charters the average age is also very high. If we only count the vessels whose charter is expiring in 2023 or 2024 they average over 13.2 years.

Management & Related Party Transactions

Any serious analysis of a Greek shipping company requires this type of research.

First off, let’s start with Tsakos’ family share ownership. They own around 26% of the shares outstanding in TNP 0.00%↑ and additionally they own 310 000 Pref. D Shares, 130 000 Pref. E Shares and 150 000 Pref F shares.

The stake in the common shares is around 120M$ and their stake in the preferred shares is around 38M$, which nets them around 3.5M$ a year.

Additionally, the CEO of Costamare CMRE 0.00%↑ owned an almost 10% of the shares outstanding and has been disposing of them over the past year. Just yesterday (31st Jan) there was a SEC filing where it was disclosed he has almost liquidated his entire stake, and in his previous filing in September it was a 5%.

Following the ownership I had a look at their related party transactions and I have to say it wasn’t very pleasant seeing the amount of fees Tsakos’ related parties are making but to sum it up they make fees when:

Selling a ship.

Buying a ship.

Chartering a ship.

Fees for arranging the transport of the crew to the vessels.

Fees for insuring the hull and machinery.

Technical management fees.

Many shipping companies do this, but at the same time Tsakos has been aggresively diluting shareholders until very recently.

Something I found quite funny is that since 2002 the CAGR in the DWT they manage has grown from 2.2M to 8M, by approximately 6.7%, whereas the shares outstanding has grown from 6.81M to 28.17M, for a 7.4%.

-The Tsakos family owns 26% of the shares outstanding, surely they’re aligned with shareholders.

Well, at 17$ a share that’s around 120M$, and if we look at the past three years they have made more or less that amount in fees. Sure, it’s not purely fees, they make real work aswell but the real cost is simply very opaque, we don’t know how much they are overcharging, but Tsakos’ expenses are definitely higher than industry average.

They even have listed as a liability their contractual obligations to their private company. That is only to ‘Tsakos Energy Management’ though, as you see they make fees from four other companies.

I might be skeptical, but I think you need to be when investing in these kind of companies. With the cash flows from this year and the ships sales they should have enough for the prepayments on the newbuilds, so I don’t think they’ll use the ATM anytime soon and given the good outlook for the tanker market using it would completely shatter any investor sentiment. But really their main goal for the past 20 years has been to grow the fleet, not to create shareholder value.

Final Remarks & Conclusion

Tsakos is trading at very cheap multiples and over time once their charters expire their earnings should rise. It is trading at a big discount to NAV but, will the gap close?

On the one hand management has said they are not going to do share buybacks which would be the best return of capital but during the latest Capital Link interview two weeks ago they said the following:

“During good times our dividend policy has been in between 25 and 50% of our net income and I think we will not change this” - Nikolas Tsakos

If they actually implement the policy and tanker rates remain healthy we could see a rerating in the stock. For instance, if they applied the policy during the Q3 the dividend would have been from 0.375$ to 0.75$, 9 to 18% annualized dividend yield which would make it one of the highest dividend yield tanker stocks.

After reviewing other companies I think TNP 0.00%↑ is the most attractive one if you are looking for 'dirty' tanker exposure, but I find other product tanker companies with dividend policies like TORM or Hafnia very interesting aswell given the possible catalyst in the EU Russian diesel ban and similarly low valuations.

Finally, we can’t forget about the corporate governance discount. The amount of fees they’re getting is outrageous and their costs seem higher than what they should be. I don’t like that companies overcharge investors, specially in this sneaky way, but it is what it is.

In the end, it’s up to you to decide whether you find Tsakos as an attractive investment. What are your thoughts on TNP 0.00%↑?

Thanks for reading the article, I hope you liked it and if you agree or disagree I’m happy to talk about it here or on Twitter, so feel free to comment.

If you enjoy my content make sure to subscribe and it would be really helpful if you can share the article.

Appreciate the write-up. I learned a lot! Definitely a risk/reward scenario worth contemplating.

Regarding fees, every now and then they pay themselves a bonus for all the hard work they do. This year it was a 1.0 m which i totally disagree with.

Regarding the 20 year dividend history, the last few years they have been lacking and I find it irritating the MGT keeps touting 20 years of dividends. Length of time doesn't matter, the amount does. Nordic American Tanker (NAT) does the same thing, totally bogus and it loses credibility.

Third, you didnt mention the 20 years of constant asset write downs. Go take a look at annual report and look for the line called impairments. So their pricing policies doesn't cover (residual value risks) the risks of asset impairments in poor markets. I believe they'd rather have a bad deal than no deal at all. don't like the focus in one sector. TNK focus on midsize, DHT vlcc large sizes.

They are all over the place with investments in dirty small med large, LNG, product tankers etc

When they do have an impairment , they stress its non cash...duh thats because the cash has been previously spent in a prior period

Fourth, the transparency sucks as far as I'm concerned. They took the share count from 19.6 m to over 28 m in one year and didn't say a peep about it. Look at quarterly reports. They show avg shares O/s and not actual count and they dont show a detail funds flow statement. Many shares were issued at 8 or lower. Is that good capital management?

Fifth, late reporting of results. They still haven't issued the detailed 6-k for q3 and we are in Feb 2023, wtf!!

They have "lucked out" with a rebound in LNG rates and tanker rates.

Ive been in and out of this name for last 25 years.

The best reason to own it is operating leverage in firm markets. But if we have firm markets other companies will do well too. Today as I write this tnk is up 8 % whilst TNP is 4.5 %so it's lagging

One final suggestion, calculate a FCF to EV rate. You pointed out the ev is 2.5 b. I want to make 20 % min. 20 % of 2.5 b is 500 m . Will TNP do that?