Hey guys I wanted to make an update on my portfolio and on the positions I recently wrote about (Grindrod & Geo Energy).

Here’s the link to the article I wrote on the 10th of October on Grindrod:

Therefore let’s just start with dry bulk and Grindrod:

FFA’s have dropped sharply since I published the article on Oct 10 due to various reasons, but mainly due to China’s slowdown in the property sector which has made Chian’s steel output hit a 4-year low.

China also ramped up their local coal production so that has probably affected aswell, since more local production = less coal imports. That coupled with Q1 being the seasonally weakest quarter and the Beijing winter olympics taking place in February has caused a sharp drop in rates. Despite the drop, Supramax rates have been holding up relativelly well compared to Capes and Panamaxes, and they are currently the most expensive dry bulk ships to charter despite being the smallest of the three (good for Grindrod).

The decline in FFAs is still very significant for supramaxes. Even though current rates (25k for Q4 - 20k for Q1) are still very profitable for supramaxes, they have gone from being literal money printers at 35k+ to being pretty good rates. At 20k Grindrod would currently trade at a PE of around ~3, which is still very low.

Supramax FFA’s in Oct 10

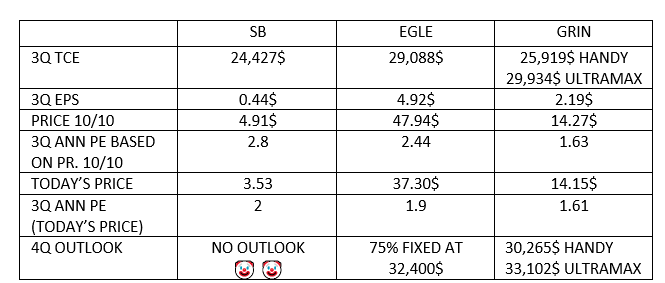

Finally, let’s compare Grindrod with the peers I used in the article (EGLE & SB). SB has seen the biggest drop, and to be honest, it’s completely justified. Safe Bulkers was very overvalued compared to peers as I suggested in the article. They also released some pretty mediocre results and haven’t still implemented a dividend policy. To be honest, I would not be surprised if SB drops even further, I think it’s completely justified that they should trade at a discount to other peers like Eagle and Grindrod.

Eagle has also dropped but they recently paid a 2$ dividend so the real drop including dividends would be slightly lower. Even though I am not a big fan of Eagle due to its convertible bond I think it might be worth making a position at current prices.

At the same time Grindrod is pretty much even, the share price is hovering around 14$, so 1 to 2% down. Grindrod has been one of the top dry bulk performers over the past month.

When I made the article I thought Grindrod was simply undervalued in general (due to how high FFAs were in Q4/Q1 back then) and also undervalued relative to peers. Conditions have changed and FFAs are a 30% lower now, Grindrod’s stock has outperformed peers and, even though I would still pick Grindrod out of these three companies, I think the undervaluation gap compared to peers is not nearly as big as it was. If I had to pick a dry bulk company to own long-term I’d definitely choose Grindrod but if you are looking to trade the stock I am not sure Grindrod has much room to go up in the short term unless rates go up. I am actually very surprised to see Grindrod trading so well relative to peers despite rates falling down.

Looking back at what I wrote in the article I think it was very accurate. Grindrod generated a little over a 15% of their market cap in this quarter, will likely generate around a 20% in Q4, and the market is starting to realize they definitely don’t deserve to trade at a discount to peers. Despite dry bulk rates crashing hard over the past month the stock is up over this time period.

Overall thoughts on 3Q results:

Good results, even though I really don’t think they are that surprising, as I modelled in the article the EPS are quite close, even though my model gave them a slightly higher EPS my numbers are usually +-10% around the actual EPS, and I did not take into account that most companies would have higher expenses due to higher bunker prices, so I missed the EPS by a bit more than 10% on Eagle, 5% on Grindrod and missed SB by quite a lot aswell.

Peer comparison and outlook from 10th of October

They have also paid a dividend of a 30% of their net income as their dividend policy states and purchased 91,871 shares during the third quarter (even though I already mentioned that in the article).

Overall good results, good outlook, not very surprising in my opinion given the outlook they gave.

Grindrod’s outlook: Based on 3rd quarter operating days they have fixed a 78% of their handysize days and a 70% of operating days for Ultramax.

As I mentioned in the article, Grindrod was very likely to outperform peers in the future due to their JV acquisition. Grindrod’s stock would have needed to rise a 50% (21.5$/sh) to trade at the same annualized PE (based on 3Q) as Eagle on the day I published the article (10th of Oct).

Something that has caught my attention is that they have released their purchase option prices and daily time charter rates. As I mentioned in Grindrod’s article I think their purchase options are one of their main appeal over other dry bulk companies, since they can easily reduce their breakeven on ships they have already been operating for a few years at prices below market rates.

From these prices I’d say the most attractive purchase right now would be the IVS Naruo, a 2014 Supramax for 16.1M $. Its daily charter-in rate is much higher than the IVS Pinehurst and the purchase price is 2M below Pinehurst, so I think that’d be the one that’s most attractive to buy at the moment. Pinehurst is also quite attractive to buy at 18M $. Then I’d say the most attractive buys would be the IVS Atsugi and IVS Pebble Beach, since they are ships from 2020 and its purchase option is almost the same as the IVS Hayakita (2016-built).

Even though ship prices have probably fallen a bit since rates have crashed these are the latest sales from Seasure 12th of Nov report:

A 2016-built Ultramax was recently sold for 28.5M$ and two 2012-built for 22M$, so their purchase options are definitely valuable.

As I’ve also highlighted in their charter-in costs, the average of their TC-in rate is around 12,500$ (excluding Pinehurst) whereas the IVS Pinehurst charter-in cost is ‘only’ 9,000$.

What about the cost to operate their owned fleet?

I’ve used numbers from this quarter to calculate their OPEX+Interest expense per day per ship, which amounts to ~6700$/day. I’ve excluded G&A per day costs since those are company-based expenses and I guess not included in the charter-in costs.

With this number I’ve calculated how much would Grindrod eventually save if they were able to execute all their purchase options. I’ve used 7500$ for their owned fleet costs (I like to run conservative numbers), and they’d save 2M$ per quarter, which is a decent amount.

Conclusion:

I think Grindrod is still attractive at current prices relative to peers, but dry bulk rates have crashed so I think Grindrod’s stock will probably trade close to the sentiment in dry bulk freight markets in the short term. What I mean by this is that I think Grindrod is still slightly undervalued compared to peers (despite the recent stock outperformance), but the dry bulk freight fundamentals look a bit uncertain for the next months. I would say after Q1 rates will probably go back to pretty high levels (25k$+ probably), but given the uncertainty around China’s property market I am not sure if they will get back to the levels we’ve seen this year (35k$) in 2022.

Fourth quarter results should be better than this quarter (2.5$+ EPS probably), even though they still have around a 25% of open days for their fleet and charter rates are now lower than their outlook, so their 4th quarter TCE will probably be lower than their outlook.

Overall, Grindrod is still attractive but I think it was a much better buy back in October 10th based on peer valuation and dry bulk market fundamentals.

That’s it for now, I’ll post another article with my thoughts on the coal market and Geo Energy Resources by next week.

You can follow me on twitter if you liked the article - NateValue and I’d appreciate if you share the article aswell!

Great post!