GRINDROD SHIPPING HLGS: AN UNDERVALUED DRY BULK GEM.

Grindrod Shipping Holdings (GRIN) is a South African dry bulk operator listed in both the Johannesburg Stock Exchange (JSE) and in NASDAQ. They operate a fleet of 15 owned handysize, 9 owned supramaxes/ultramaxes and 7 more in long term TCs. Five of their chartered-in supramaxes have purchase options attached.

SUMMARY

The Baltic Dry Index, the index that tracks the spot rates of dry bulk ships recently hit a 11-year high.

Grinrod is poised to be one of the most benefitted dry bulk companies in the upcoming quarters, due to its high spot exposure (90% of fleet) and due to the outperformance of smaller shipping segments.

Up until this quarter Grindrod filed their results semi-annually but going forward they’ll be filing quarterly.

They had some legacy tankers but they liquidated them over this year.

They have bought back 33,467 shares at an average price of 8.46$ per share during the last quarter and 91,871 shares at 14.87$/sh during the 3rd quarter.

They have set up a dividend policy consisting of a minimum of 0.03$ per share plus a 30% of their adjusted net income.

They bought the remaining stake in their IVS joint-venture. I believe that considering current dry bulk rates and FFAs the purchase is extremely attractive. They also purchased one of their long term charter-in vessels recently.

I believe all of these actions have created massive value for shareholders and the market is not rating Grindrod’s management accordingly.

DRY BULK MARKET REVIEW

Dry bulk charter rates have been very strong this year, reaching levels not seen since 2008. Charter rates for smaller segments (Handymaxes and Supramaxes) have been steadily rising over the past months and have been much more stable than the rates of bigger classes, like Capesizes and Panamaxes.

In general I am quite bullish for the next few years for dry bulk. Even though rates might be higher than they should be due to logistics issues, the orderbook for these ships is very thin. Most recent newbuild orders for drybulk vessels are scheduled to hit the water on the second half of 2024, so even if you wanted a new ship right now there is simply no possibility to add more capacity for at least 2 to 3 years. This is due to the frenzy of newbuilds that there’s been in containerships and other classes like LNG and LPG carriers. It’s also important to note that bulkers are probably the easiest vessels to build out of the major shipping asset classes (LNG, containerships, tankers, LPG and bulkers), therefore the margin on building these vessels is the lowest compared to other classes, and major shipyards will usually prefer to build more complex ships with higher margins.

Given that rates are already really high, that the orderbook is tiny and that there is simply no possibility to add more ships until 2024, I think dry bulk shipping will enjoy a few years of high rates. At current levels every single dry bulk class is printing money, but if demand for commodities picks up in the next few years I think we could see rates going even higher, or at the very least staying at its current level which is already extremely profitable.

If the huge infrastructure plans from the US, Europe and China are executed that could be a great catalyst to increase demand for dry bulk commodities.

Dry bulk supply/demand growth outlook. Source: GOGL 2Q presentation.

The FFAs curve implies that rates will go down from around ~40k in November to ~30k in Q1. Although that makes perfect sense, since Q1 is the seasonally weakest quarter for dry bulk, I find it curious that FY22 FFAs are trading at less than the Q1 ones, implying that rates in the seasonally strongest quarters of the year will be lower than in Q1. For the FFA curve to be right, rates in Q2-Q4 would have to average around 23k per day.

Source: Braemar

GRINDROD’S HIDDEN VALUE: IT’S CHARTERED-IN FLEET

Grindrod’s has a fleet of 7 long-term chartered-in vessels (the IVS Phoenix was acquired recently). While in a weak market these charters were punishing Grindrod due to their higher breakeven compared to owned vessels, now that the market has turned I think it is one of their biggest strengths.

Note that most of their charters come with purchase options attached. The price of the purchase option is usually agreed upon signing the long-term charter-in, therefore, if market rates stay at current levels for some time, the value of those vessels will probably rise accordingly, so Grindrod could just execute the options to buy the vessels and sell them at current market prices.

I feel like Grindrod is in a great position since they can slowly acquire these vessels lowering the cost of operating their fleet, but they don’t need to do it right away, they can just wait on a lot of those charters and see if rates for 2022 and 2023 stay at current levels, and if they don’t, they can just let those charters expire.

The only downside that one could think from this strategy is that some of these charters will expire, so if charter rates are strong their fleet might shrink, but actually only two vessels don’t have options attached. Crimson Creek is expiring in 2Q 2022, so unless they are able to extend the charter or purchase the ship they’ll have one ship less from 2Q 22 onwards, but IVS Windsor, the other one without a purchase option attached isn’t expiring until 2026, so they have 5 years until that happens.

IVS PHOENIX ACQUISITION

As I said previously, Grindrod was able to acquire one of their vessels that had no option purchase attached recently. When I read their SEC filing I was very pleasantly surprised by the price they paid. Grindrod paid only 23.5M USD for that vessel, a 2019 Japanese-built Ultramax.

After checking the latest supramax transactions I found out that last week two 2016 supramaxes were sold for 29M USD!

Source: Seasure Oct 1 Report

Therefore we can assume IVS Phoenix has a market value of more than 30M USD at the moment. Not only they secured a very low purchase price but with the financing of the purchase their breakeven on that vessel will be much lower. Great job from Grindrod’s management.

IVS JV ACQUISITION

Up until last quarter, Grindrod had a Joint Venture and they didn’t own a 100% of some of their ships, but on July 26th they announced they had purchased the remaining stake for 46.3M USD.

Grindrod’s fleet pre-acquisition. All the vessels 68.9% owned are now 100% owned.

We can see that acquiring the remaining JV stake equals to buying: 1.86 (0.31*6) Handymaxes (avg age ~2015) and 1.86 Ultramaxes (avg age ~2016). The purchase price was 46.3M USD. Given that a 2016 Ultramax market value is around 30M USD and that there were recent transactions for two 2013-built Handysizes for 20.6M USD, we can assume that the current market value of the IVS stake they acquired is around:

· 1.86* 30 + 1.86* 20.6 = 94.11M USD

Source: Seasure Oct Report

Given that the current market value of the ships acquired is around 95M USD they have generated almost 50M USD in value from this acquisition alone. Great job again from Grindrod.

Additionally, Grindrod will economically benefit from the acquisition from April 30th, but those additional earnings were not included in the 2nd quarter report, so we can expect they’ll be added for the 3rd quarter or for the 2021 yearly results. Given that they earned 1.02$ per share in Q2 and that the IVS acquisition means a 14% fleet increase for two months (May and June) we can expect they’ll add around 0.10$/share in earnings from the acquisition to Q2 earnings.

INSIDER OWNERSHIP

Source: TIKR.com

Murray Grindrod(Non-Executive Director) : 7.66% ownership.

Martyn Wade (CEO): 0.74% ownership.

Stephen Griffiths (CFO): 0.39% ownership.

Even though insiders don’t have a huge ownership of the company, its main shareholder (Industrial Partnership Investments Propietary Ltd) is a 100% subsidiary of an investment company called Remgro Ltd (South African listed company) and they have two Executive Officers on the board, so I’d say their interests are aligned with shareholders.

BALANCE SHEET

Grindrod has a net debt of 195M USD as of Q2. Considering its current market cap is 275M USD, its enterprise value is 471M USD. The market cap represents around a 58.5% of the total EV.

Its metrics for debt to equity or debt to assets that are given in Grindrod’s balance are (generally speaking) quite useless. This is due to the fact that shipping assets’ value are quite volatile, and shipping companies don’t usually update their values very often.

According to their CFO their current leverage is about 46% and they would like to lower it to 30%.

VALUATION

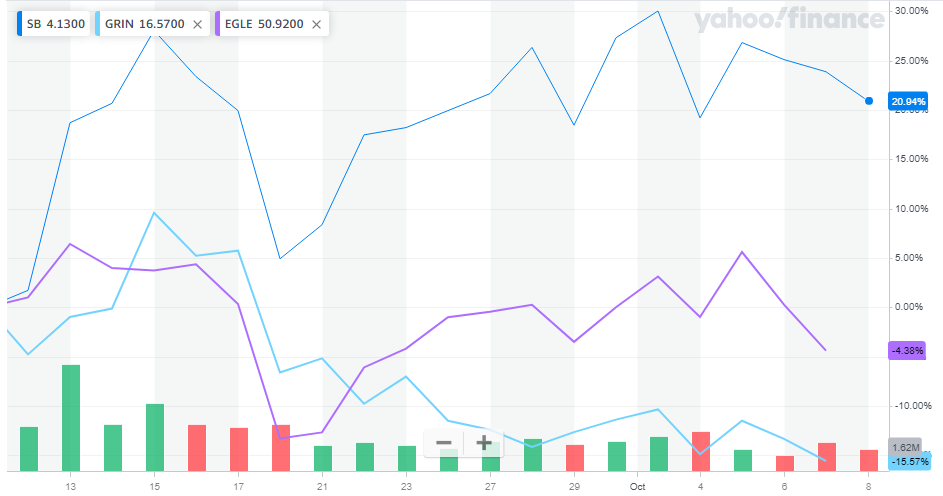

I will be comparing GRIN with two other dry bulk operators, Safe Bulkers ($SB) and Eagle Bulk (EGLE). The main focus of my comparison will be their earnings potential based on models I’ve built for these companies as well as their latest earnings. Eagle Bulk is probably its closest peer, since they operate a fleet of 26 ultramaxes and 27 supramaxes. SB operates mainly a fleet of panamaxes with a few capesizes, whereas Grindrod operates a fleet of Handymaxes and Supramaxes/ultramaxes.

I also have to mention that for Eagle’s earnings I have used their adjusted, non-diluted earnings, since Eagle uses future contracts to hedge their fleet and they exclude the unrealized gains/loses in the adjusted earnings, but the reality is that those unrealized losses will eventually be realized losses given the strength of the dry bulk market. They also have a convertible bond that might eventually be converted to shares so their total diluted share count is a lot higher than their current share count.

From this data Safe Bulkers seems a bit more expensive than the other companies based on its PE ratio, whereas Grindrod and Eagle look cheaper and similarly priced.

The reality is that Grindrod’s earnings are likely going to outperform Eagle and Safe Bulkers in the future due to different factors I’ll explain now.

SPOT RATES EXPOSURE

Safe Bulkers: Safe Bulkers has a mix in between spot exposure and time charters. Their time charters are not terrible (looking at you $DSX) but they’ll obviously lag other listed peers that opt for a more aggressive spot exposure.

Eagle Bulk: Even though their fleet is fully spot exposed, they hedge the exposure with FFAs.

They have around 10 ships out of 53 (~19%) hedged for Q3, 11 for Q4 (~21%) and 6 ships for one quarter of 22’.

Grindrod’s fleet has an almost 90% spot exposure. Despite not being a 100% spot exposed, in the last quarter they outperformed Eagle’s in the Supramax segment and their outlook is significantly better in that segment. On a fleetwide basis, Grindrod’s should achieve slightly lower rates since half of their fleet are Handymaxes as opposed to Eagle’s fully supramax/ultramax fleet and Safe Bulker’s mixed fleet of Capesizes and Panamaxes/Kamsarmaxes.

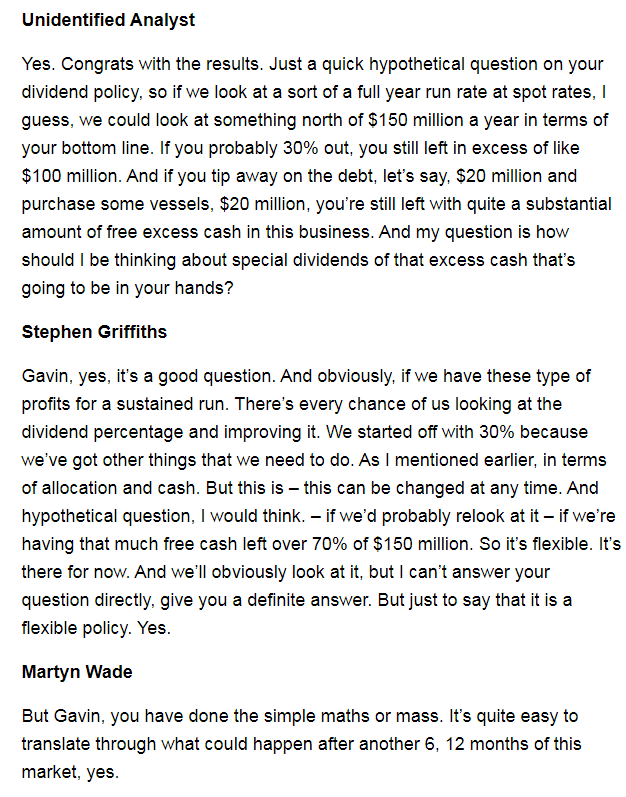

Grindrod’s 2Q conference call.

As we’ve seen, Grindrod is trading at cheaper multiples based on annualized second quarter earnings, and their guidance for Q3 is better than Eagle’s and probably better than Safe Bulkers’. Not only that, but Grindrod acquired the remaining part of their JV, so their forward earnings will be even better.

FORWARD VALUATION

I will now compare their forward valuations based on models I’ve built for these companies. I’ve used their average numbers for the past year to account for their expenses (average OPEX/day per ship, average interest expense, average utilization and G&A) and using the outlook they gave for Q3 with the number of ships they have. I’ve also accounted for additions in their fleet, so for Grindrod we’ll be modelling based on their total ships after the purchase of the IVS JV. In general the models I’ve built have been relatively precise in the past (+-10%).

*Safe Bulkers did not provide 3Q TCE guidance therefore I’ve used 25000$. Given that their earned 21000$ in 2Q and that their fleet has a lot of longer-term time charters I think it’s a reasonable TCE assumption.

Again, for Eagle Bulk I’ve used their adjusted non-diluted earnings. Despite adjusting their earnings Grindrod looks much cheaper based on their third quarter earnings. This is due to: outperformance from Grindrod in TCE – I’m using 27500$ for Grindrod and 28000$ for Eagle but half of Grindrod’s fleet are handysizes so I think Eagle’s should have a bigger advantage than only 500$ in TCE. In the supramax/ultramax segment Grindrod definitely outperformed them by 2000$ when they provided the outlook.

Though the biggest reason for the outperformance is the vessel additions from their JV acquisition. Before the acquisition Grindrod operated “27.28” vessels (adjusting for their non-owned stake in the JV) and for Q3 they’ll operate 31 vessels (14% fleet growth in one quarter).

If I adjusted Eagle’s earnings for their their 3rd quarter FFA losses Grindrod would look even better. When it comes to Safe Bulkers, the stock has risen a 20% over the last month whereas Grindrod is down a 15% and Eagle is almost flat over the last month. Safe Bulkers is simply trading at higher multiples which I don’t think are warranted given that they have no dividend policy and that their spot exposure is lower than other companies.

Given the 30% payout ratio if Grindrod achieved these rates for a full year they’d be paying a dividend of almost 19% yield at its current price.

Management is aware that if high rates are sustained they’ll consider improving the dividend policy. Given the sustained strenght in Q3 and so far in Q4 I think they’ll probably execute some options on their ships and by next year they’ll improve the dividend policy. It’s nice to see management being flexible though, and I think given how cheap their purchase options are it is very reasonable to pay a 30% of net income and use the rest to execute their options and lower the breakeven on their fleet.

$GRIN - currently the market cap stands at $273m. This quote is from August earnings. At $150m in profits, Grindrod would trade under 2x earnings.#drybulk gives you lots to be excited about.Credit to @danjbianchini on Twitter

GRINDROD’S EARNINGS GROWTH

One final touch I wanted to add is that despite Grindrod doing very well already with its current fleet they have a very clear path of growing their earnings at very cheap prices. As I’ve mentioned before they have option to buy 6 vessels. Management already confirmed during their 2nd quarter conference call they’d be executing their purchase options slowly.

The purchase price of these options are at a steep discount to current market prices and their chartered in fleet currently costs Grindrod around 3000$ per day per ship more than their owned fleet, so over the coming years I’d expect Grindrod’s costs to go down.

Not only that but another avenue to increase profitability would be to reduce their interest expense. Grindrod had a net debt of 195.5M USD as of Q2. If rates for Ultramaxes stay above 25000$ (ultramaxes’ current rates are 38k+) Grindrod could pay most of their debt in a few years, and given the strength of the drybulk market it is also likely Grindrod could refinance their debt at lower rates.

WHY IS GRINDROD CHEAPER THEN?

I don’t think there is one precise reason as to why Grindrod is cheaper, but I think these factors may affect its valuation.

There was a recent secondary offering by Grindrod Limited (main company that had shares from the spinoff). They were simply a forced seller, as they mentioned they wanted to reduce investments on non-core business strategies, and they accepted a very hefty discount, selling shares at 13.5$ when Grindrod had been trading at 16$-19$ the weeks before the offering.

The Company has received notice from Grindrod Limited that on 23 September 2021, it has disposed of its entire interest, consisting of 1,841,962 ordinary shares in the Company, which represents 9.60% of the 19,185,352 ordinary shares in issue (excluding 124,672 treasury shares) on 23 September 2021. This is in line with Grindrod Limited’s commitment to reduce investments that are “non-core” to its current business strategy.

Low liquidity restricting funds from holding $GRIN.

No options.

Despite all this, I don’t think the discount is warranted. I could understand Grindrod trading at a discount a few months ago, when their fleet was a mix of tankers and dry bulk vessels, and when they filed results semi-anually. But they have fixed all of these issues and management has proven to create a lot of value for shareholders.

CONCLUSION

Given the strength of the drybulk market and with no orderbook on sight I’m quite optimistic about Grindrod’s future. Even if charter rates collapse next year, Grindrod will be generating over a 15% of their market cap in Q3 and likely more than 20% in Q4.

Considering how much value has Grindrod’s management created over the past year, and how much hidden value they have in their options attached to the chartered-in fleet, I don’t think they should trade at a discount to peers.

When it comes to management, I think they also deserve a premium compared to the peers used in the article (SB and EGLE). To sum up, they’ve executed all these corporate actions over the past year, which is a lot more than most other listed shipping stocks:

· Dividend policy (30% of net income).

· Buybacks.

· Simplifying their fleet (selling tanker fleet) and changing their filings from semi-anually to quarterly.

· Creating value through opportunistic buys of their JV and IVS Phoenix.

· Good transparency from management: they announced most of these changes before they executed them. Their CEO has also given multiple interviews over the last months, which I’d really recommend listening to them.

Overall, I think Grindrod offers one of the best risk/reward among dry bulk equities, with a premium management aswell.

If you liked the article you can follow me on twitter at @NateValuetw . Feel free to comment here or on Twitter.

Disclosure: I am long Grindrod Shipping Holdings. This is not investment advice, do your research.

Hi Alex, super interesting, many thanks.

Frankly, I have 0 experience with shipping investments. Couple of questions / comments:

- Why wouldn't management focus on sweeping away the debt with FCF? They already paid back over $80m in H1. Deleveraging alone should make this quite interesting, no?

- With regards to capital allocation, I would understand if they would focus on share buybacks if they think the Co is clearly undervalued, but the size of the buybacks is not necessarily impressive. What's your take on this?

- What do you think is the market missing and what is in your view triggering a rerating? Simply Q3 / Q4 reporting?

Also, do you have any recommendation for a publicly available primer / "shipping for dummies"? Would be neat to understand the fundamentals of this business.

Cheers

Congratulations, a first class job. Having invested 3% of my portfolio in Grinrod myself, your analysis gives me confidence that I am on the right path to success and encourages me to increase my position in the $14-15 range.

Thank You so much.