Dry Bulk Shipping Market Review

Reviewing the current market, the market outlook and stock valuations.

Disclaimer: The information provided here is for general informational purposes only and should not be considered as investment advice. I am not a financial advisor and do not offer investment recommendations. Before making any investment decision, it is important to conduct your own research and seek the advice of a qualified financial professional. - Disclosure: I do not have any long position in dry bulk stocks. I am currently short Golden Ocean ($GOGL).

Today's article will review the dry bulk market and my thoughts on the equity valuations of different dry companies.

What is dry bulk shipping?

Dry bulk shipping refers to the transportation of dry unpackaged goods such as coal, iron ore, grains, and building materials by sea in large vessels. These carriers are specifically designed to carry large quantities of dry bulk cargo and are equipped with cranes and conveyors for loading and unloading the cargo. The demand for dry bulk shipping services is largely driven by the global trade in raw materials, as well as the growth of the construction, agriculture, and energy industries.

How has the industry done historically?

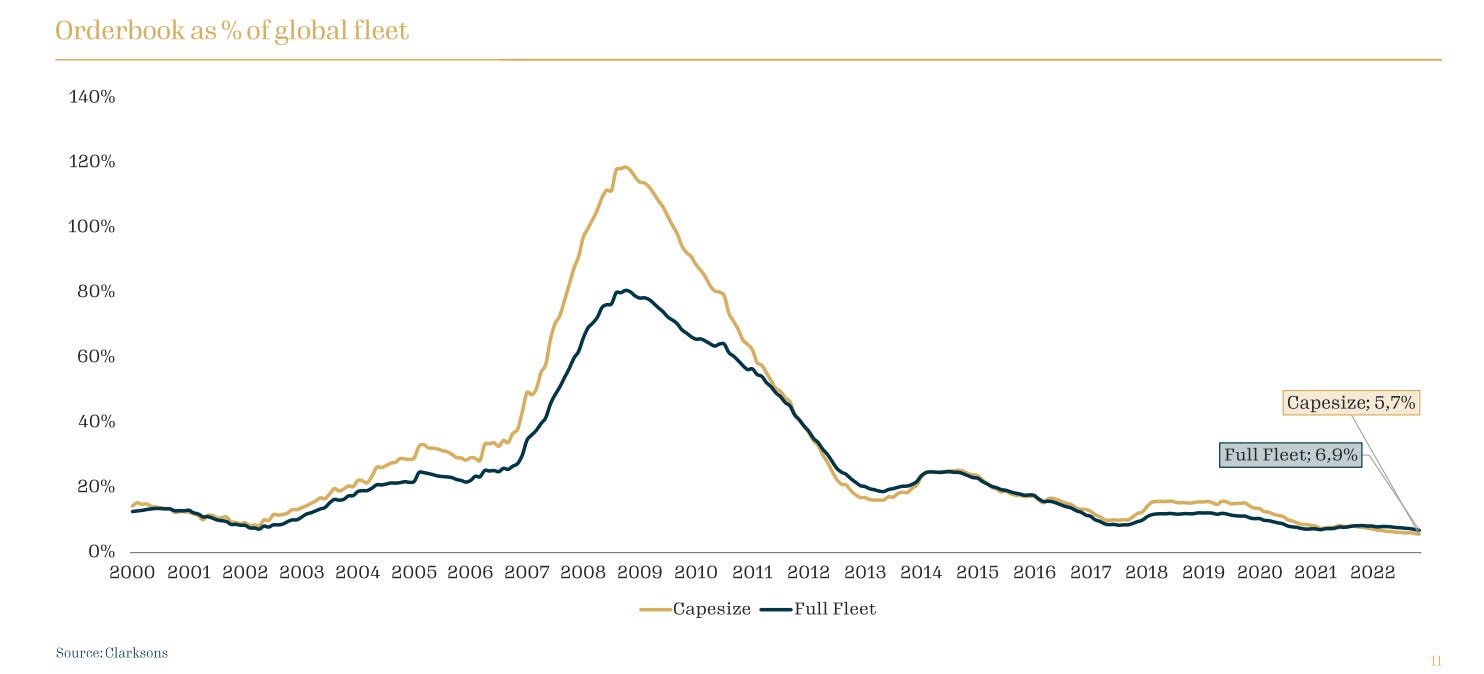

Like pretty much every shipping segment, there was a big spike in rates during the mid-2000s due to China's rise. That led to an order book of over 100% of the fleet for some segments. When the Great Financial Crisis hit and the new ships started hitting the water, well, you can see what happened to rates.

During 2021 and 2022, rates rebounded and dry bulk companies enjoyed a mini bull cycle, which has started losing strength over the past two quarters.

The Baltic Dry Index is currently trading at a 3-year low, close to the level it was during the first COVID quarantines in 2020. In general, dry bulk stocks tend to exhibit a strong correlation with the BDI; however, over the past 6 months, many stocks have shown little correlation with the underlying freight rates.

Seasonality and FFAs

The Chinese New Year usually marks the low point for dry bulk rates, so there will likely be some rebound after CNY, but the FFAs are already pricing in a steep increase in rates for the second quarter. For those not familiar with shipping, FFAs are financial derivatives that allow parties to lock in a future price for a particular route.

The thing is, the rates FFAs are implying are close to breakeven levels for many segments. So even if this rebound happens, they're not going to generate meaningful cash flows.

As a matter of fact, since I started writing the article this weekend rates for March have gone down by a further 10%, so it seems FFAs are adjusting their expectations to reality.

Dry Bulk Near Term Outlook - China

Let's first look at the near-term outlook. For the past few months, there has been a narrative that since China has abandoned the Zero Covid Policy, rates will rebound again. However, I am a bit skeptical about this. During 2022, China still had its COVID policies and dry bulk rates were quite good, especially for smaller segments like Supramaxes and Panamaxes. Even Capesizes did very well compared to the pre-COVID years, but rates have been slowly sliding down across all segments since the second quarter of 2022 and have recently cratered.

In fact, for some companies, the second quarter of 2022 was stronger than any quarter in 2021.

Source: BANCOSTA Weekly Report 05/2023

In my opinion, the weakness in rates could have more to do with the weakness in the Chinese economy and the collapse in its real estate sector than with COVID policies. China’s real estate collapse was a big mess, and these structural issues are unlikely to be fixed in the short term, so I think it will take some years before real estate development goes back to 2021 levels.

While there has been some recent strength in commodities related to steel production such as metallurgical coal, the recent news headlines don't seem very positive. We'll have to wait and see how the situation develops.

ArcelorMittal Warns on Steel Demand as China Seen Flatlining

China's soft infrastructure growth seen jamming breaks on steel demand in 2023

The Boom, Bust and Future of China's Real Estate Sector

Dry Bulk Medium to Long Term Outlook

I believe the outlook for dry bulk looks promising a few years down the road. The current orderbook is significantly lower than historical levels, and I don't anticipate companies placing orders for new ships if rates remain at their current levels.

In fact, we should start seeing demolitions pick up over this year. Current rates are very unprofitable for most segments and keeping older vessels trading becomes quite expensive from the 20-year mark since they are required to undergo expensive special surveys more frequently.

At the same time, there is still uncertainty regarding future regulations in shipping propulsion, and dry bulk is probably the most affected segment by this. Dry bulk ships are the most simple and cheapest to build out of the major shipping segments, so the propulsion technology represents a higher percentage of the ship cost. If new regulations are introduced, compliance could be significantly more expensive for dry bulk ships compared to other segments where propulsion technology represents a smaller percentage of the cost.

Equity Valuations

Companies need to take different approaches to maximize profits depending on whether the market cycle is strong or weak. During a strong market cycle, a company with a leveraged balance sheet and an aging fleet trading mainly on the spot market is likely to generate the most profit. However, during a weak cycle a company with low leverage, a young fleet equipped with scrubbers, and a significant number of fixed-time charters would be more favorable.

I would personally avoid companies that have a high exposure to the Capesize segment, since it relies heavily on the Chinese economy and infrastructure spending.

Given these preferences and the current uncertainty in the freight market, Safe Bulkers appears to have one of the best risk-reward profiles, due to their mix of long-term time charters, decent scrubber coverage and a diversified fleet across different dry bulk segments. Additionally, their price to NAV valuation is one of the lowest in the sector. Their fourth quarter results were out a few days ago and they posted 0.29$ in earnings per share for a company that’s trading at around 3.25$. Although their earnings in the upcoming quarters are expected to decline they are well-positioned to weather a weak market cycle.

On the other hand, Golden Ocean has one of the least attractive risk-reward profiles in my opinion. Their fleet is heavily focused on the Capesize segment, it trades mostly on the spot market, they are trading at slightly above NAV values and their leverage is relatively high. At the same time it’s very likely they won’t pay any dividend for the fourth quarter since they recently acquired six secondhand ships plus they have six other newbuilds hitting the water on 2023, so they’ll have to post some equity and given the weak market for the first quarter it would be wise not to have any additional cash outflows.

Conclusion

In conclusion, there is a lot of uncertainty regarding dry bulk for this year. Despite the weakness in rates, most stocks have not followed the historical correlation with the Baltic Dry Index. In my opinion the risk reward for most dry bulk equities is not positive at the moment and given the current overall equity valuations, it would be wise to wait and see if rates actually rise before making any investment decision.

Thanks for reading the article, I hope you liked it and if you agree or disagree I’m happy to talk about it here or on Twitter, so feel free to comment.

If you enjoy my content make sure to subscribe and it would be really helpful if you can share the article.

I agree and wonder the same for rather some time.

Is your opinion on the Dry Bulk Shipping stocks still the same, given rates are steadily climbing, although from a very low levels?