Annual Review 2022 & Outlook for 2023

+41.53% for 2022

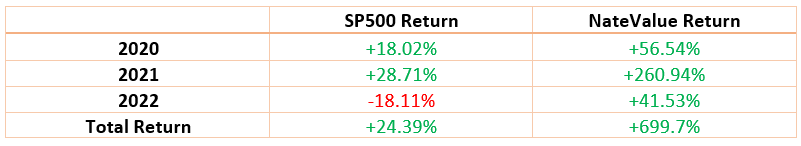

Here is my annual review for 2022. My returns for the year have been +41.53% and +699.7% since April 2020.

When it comes to asset classes stocks represented 36.89% of net performance, options a 7.21% and cash a -2.79%. ETFs and warrants were negligible.

Top Performers:

1.- Peabody Energy (BTU): +8.47%.

2.- Thungela Resources (TGA): +5.6%.

3.- Zim Integrated (ZIM): +5.49%

4.- Coronado Global (CRN): +4.62%

5.- PBF Energy (PBF): +3.84%

Bottom Performers

1.- Corsa Coal (CSO.to): -8.17%

2.- QFIN puts: -4.26%

3.- United Oil & Gas (UOG): -2.78%

4.- USD Currency: -2.27%

Reflections

1.- What I’ve learned from my biggest losses this year is not to trust shady management teams. For both Corsa Coal and United Oil & Gas there were clear signs the management was not being completely transparent with shareholders and thus, whatever information you believe you might have on the company is not worth much.

2.- The stock liquidity is another thing I’ll be focusing for this year. As I usually have relatively concentrated positions, is it not that easy to get in and out of illiquid positions anyone, and I think that is one of the advantages that I can have over the market. Many times the market is pretty slow to react, or doesn’t fully comprehend the impact of news in a short time frame.

A clear example of this happened just recently with United Maritime Corp ($USEA). They announced on the 3rd of January that they would be acquiring two capesizes from the parent company, Seanergy Maritime. The stock opened like a 4 or 5% up that day and I was able to sell my entire position, and it obviously dropped the following days given that the news were honestly quite bad.

Then, in other companies like CSO or UOG I wasn’t able to sell despite knowing there were some bad news because there was simply no liquidity at all, so that will be something to consider

3.- Another thing I’ll be looking to change for 2023 is the amount of positions I hold. I think at a certain point it makes no sense to have smaller positions for a retail investor. Even though I am currently full time investing it just gets harder to keep track of every single position at a deep level, so I’ll be looking to concentrate on the main ideas that I have.

4.- Despite having a good performance in options I think moving onto 2023 the profitability threshold I will look for will be higher than in 2022.

Regarding options’ strategies, my favourite one has been executing straddles on stocks with high IV like BTU, while owning the stock. So basically selling a short put, a short call and owning the stock. Specially in stocks where there is no clear catalyst and you are still bullish you can make very good returns month to month as long as the stock is relatively flat. If it goes up you are collecting both the short call and put premiums plus the difference in between the stock and the short call strike. In the case it goes down you are collecting both the put and call premiums, so the loss won’t be as big.

2023 Outlook and strategies:

This past year has proven that fossil fuels are necessary and they’re going to be for many years to come, but despite record high pricing in coal, pretty much every single coal company that I follow has had a lower output in 2022 than in 2021, and most of them are focusing in buybacks and dividends instead of CAPEX programs. I don’t think current spot prices will last forever, but once they go down I belive they will settle at significant higher prices than they were before COVID.

Therefore, I believe there are lots of cyclical companies – specially in the coal sector but also in refineries, oil & gas and shipping that have a complete different balance sheet than at the start of 2022, still have a great outlook for 2023, yet they trade at a similar or lower valuation. In particular, I like investing in cyclical companies that do not necessarily live and die by the spot price of the commodities they sell.

For example, in the coal sector I still like Peabody Energy. A meaningful part of their cash flows are fixed (their entire PRB and US coal is already sold for 2023) and they had significant hedges in place for their seaborne thermal in 2022 at much lower prices than spot, which will fully expire in 1H 23’. Therefore, even if spot prices went down their cash flows woulnd’t be affected as much as other coal names.

For tankers I like Tsakos Navigation for the same reason, they are benefitting from higher spot rates but a significant part of their fleet is on fixed rates or profit-sharing agreements that are capped at much lower prices than spot. So even if spot prices went down from current extremely high levels but settled at higher prices than pre-Russian invasion they would still generate significant cash flows and actually they would go up over time as their fixed contracts expire.

On the other side, I also feel like there is a great risk/reward proposition in cyclical companies that, although they are exposed to spot prices, have a very significant part of their market cap in cash.

This would be the case for Yancoal and Geo Energy Resources. Based on conservative models I have made Yancoal should have around half of their market cap in cash with no debt on Q4 results, and Geo Energy has an enormous cash position, given that Q4 should be very good for them their net cash position will almost surely be more than 250M$, I would say closer to 300M$ probably, for a market cap of 325M$ as of now.

So far, given the coal futures strip, 2023 looks amazing aswell, but even if it dropped, as long as it settles at prices above pre-COVID levels, those companies would still be significantly profitable and their huge net cash positions should mitigate the downside even in a negative pricing scenario.

Comments on different industries

O&G: When it comes to oil & gas, I believe that high prices are here to stay. These are the main catalysts for my oil thesis:

· On the one hand, russian production has held up surprinsingly well, but I still think that over time they’ll run into issues given the sanctions on buying equipment for example, and the loss of the know-how majors could provide to russian companies, I believe it is a matter of time until their production starts dropping.

· Secondly, OPEC has proven they’re willing to cut production in order to keep higher prices. The US has been draining the SPR at a good pace, which should stop this year and actually they’ll start buying some barrels to refill it. Even if they kept draining the SPR, which would be negative for oil prices in the short term, it would just give more leverage to the OPEC in the longer term, so it wouldn’t be bad for oil prices either way.

· Lastly, many western countries have introduced windfall taxes for O&G companies which I think will discourage investment over the medium term. Fortunately no major oil producer has introduced these laws, but the sentiment from political administrations in countries like the USA and Canada is not very favourable, so in a way, I feel like the capital cycle in many of these industries is manipulated for political reasons, so even if prices rise I don’t expect a big supply increase.

I don’t call for prices to go as high as some people say to 200$, I’m perfectly content if they stay at the current range of around ~80$ for Brent, as most companies I own already generate meaningful cash flows in that range.

Tankers: The Ukrainian war has created dislocations in the oil market which will probably last for a long time. It seems that, unfortunately, the war is going to last for a long time given that no side is willing to make concessions, and even if it ended I doubt the West would lift those sanctions anytime soon. As I’ve briefly commented, rates have gone down slightly but they are still at very high levels historically. We will see where they settle, but I am pretty confident it will be at much higher levels than pre-invasion. The tanker orderbook looks amazing and despite having a few months of very solid rates there has barely been any newbuilding. Even if there was, new ships won’t hit the water for a few years.

This won’t be very popular among fintwit but I don’t think tanker equities in general are *that* cheap. Most of these companies are trading at more than 2 times cash flow to equity, but they are still heavily levered, so the EV/FCF multiples are not that cheap and this cash flow is annualizing the last quarter in which spot rates were very high.

For instance, during the dry bulk boom last year there were a few equities, like $GRIN, $EGLE and $EDRY trading at around or less than 1.5x FCF while having a lot less leverage, so in my opinion they looked a lot more interesting, given what they were earning at the time, than tankers are right now.

Therefore my main choice in tankers is Tsakos, which has its own issues, but it is not that exposed to spot rates and it’s still similarly cheap or even cheaper than other tanker equities based on FCF multiples.

Dry bulk: I am not too convinced on dry recovering fully on 2023. Despite China announcing they are reopening, rates have cratered and even the smaller classes have gone down despite holding up very well during 2022. It is true this is the seasonally weak part of the year, so after Chinese new year we will see what happens, but I’m not too optimistic.

Still, I believe dry bulk’s setup looks very nice a few years down the road. The orderbook is very low and there is still a pretty heavy backlog in most yards due to orders for LNG, LPG and containerships. I think the most attractive equity in this sector would be Safe Bulkers since it’s very cheap, and has a significant part of their fleet on fixed rates way above current spot prices.

Shorting: I have very recently started shorting companies with a small % of my portfolio, since I believe there are still very overvalued stocks out there.

Given that 1Y treasuries have gone up from virtually 0% to 4.7% as of now, how much sense does it make to invest in companies with high PE ratios, some of which aren’t even growing aggresively anymore, during a period of economic stagnation. In my opinion, it doesn’t make much sense to assume the risks and volatility of investing in those equities when you can make a 4.7% ‘risk-free’. There are also other factors which I believe make shorting equities much more compelling than a year ago which I’ll write about in the near future.

Finally, I wanted to point out a few books about investing that I’ve liked.

The first one is Capital Returns: Investing Through the Capital Cycle from Edward Chancellor. I feel like this book is a must read if you are investing in commodities, it explains very well how capital cycles work, although it gets a bit repetitive towards the end, it’s still a great book. Then I also read a few books written by Jim Rogers, which are a nice mix in between adventures and investing, and I found them very enjoyable to read aswell.

That’s all for now, this will be my 4th year investing in individual equities and my 2nd year doing it full time, I’m genuinely curious and excited to see if I can keep outperforming the market.

Finally, as I said I’m going to start writing articles consistently this year, so if you enjoyed reading this article make sure to subscribe to the newsletter and follow me on Twitter (https://twitter.com/NateValuetw). The next article will be an update on Geo Energy Resources and should be published by the end of this week.

For spanish speakers I’ve also made a YouTube video about this article:

Thank you. What do you think about GLNG?